SP-INSIGHTS

Risk & operations (1/2025)

Political risk and operational resilience - A business leaders' mitigation guide

This MITIGATION GUIDE provides suggestions to business leaders how they can increase operational resilience and protect earnings.

Introduction

Given the recent developments in early 2025, it is time to reflect where we stand on political risk and the implications this has for businesses navigating through daily challenges.

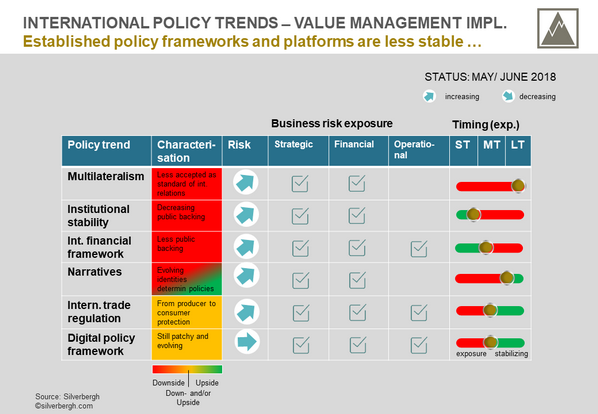

In January 2017, at the outset of the 1st Trump presidency, we analysed political risk drivers associated with evolving policy frameworks routed in `decreasing political consent`. At that time, we identified four main risk areas:[1]

- Global free trade

- International security framework

- Stability of foreign relations and multilateral political agreements

- Regulation of financial markets

On all four areas we have already experienced the realisation of risks. What has been a risk back then has now become a reality. Some businesses have been prepared, several others were caught unprepared.

However, political risk has not disappeared. On the contrary, we can describe some of the risks more accurately today. At the same time, the degree of risk and uncertainty as well as the impact some risks might have (beyond the recent tariff announcement by the US government) have increased as well. What are examples?

These would short-/medium-term be tariff changes and ad-hoc exemptions (beyond a new normal), new non-tariff policy measures (e.g. im-/ export controls even beyond own jurisdiction), changes of key economic parameters (GDP growth, FX, inflation/ interest rates, unemployment rates) and stability of capital markets, changes of goods and services flows with the potential to be cut out or face new competition but also with the possibility to access new business opportunities. Increasing security challenges might also expose operational vulnerabilities which have been less relevant in the past.

Longer-term, the current conflict might accelerate the development from a multilateral geopolitical framework towards multipolar geopolitical framework with regional hegemons. This then demands answers and potential adjustments e.g. on strategic market presence (and compatibility with the hegemons objectives[2]), operating model & manufacturing footprint, supply chain, IP protection, cyber.

The impact of the recent US tariff announcement

Econometric analysis[3] shows how different countries would be affected by the tariff changes on average. Ironically as it seems, the US next to Canada carries the highest burden (see exhibit). Volatility expectation in capital markets increased by more than 100%.[4] Additionally, inflation would be stimulated medium- to longer-term.[5] As this tariff conflict might seem to be irrational, it only proves the point that there might be additional considerations that determined the decision to introduce them. The good news is that European export-oriented economies seem to be quite robust with regard to US tariffs given the low tariff gap.[6] Obviously, a certain business might be more or less impacted depending on its industry and geographic footprint. Some might even benefit.

From a business perspective, there may also be upsides. Competitive advantages might evolve due to structural conditions or the ability to act faster and with more flexibility. New market segments might open up. New formations of trading partners might pave the way to new business opportunities i.e. closer ties between Europe and Asia, stronger alignment with Canada and Mercosur.

The trade & tariff playbook

On April 2, business leaders and economists were wondering how the US administration had derived their tariff table and what the longer-term plan might be. In essence, it is just the relationship of US goods exports vs. goods imports to/from a certain country, the country’s trade balance as a measure for the degree of ‘unfairness’. It disregards services.[7] Hence, this is not even a tariff perspective. Imports into the EU have tariffs of 5 percent (vs. 3.3 percent for imports into the US according to the WTO)[8] and are not double digit as the administration claims.The hope that this might be just another spontaneous and chaotic move is not substantiated. The opposite is the case. The policy announcement is in line with plans laid out in November 2024[9] also referred to as ‘Mar-a-Lago Accord’. Author is Stephen Miran who has been confirmed as the Chair of the Council of Economic Advisers (CEA) on March 12. This document gives a flavour on the policy objectives and reads like a playbook on trade policies with the intent to break with established policy patterns.

Some key elements of this document are:

- Aim to ‘reshaping the global [trading] system’

- Devaluation of the USD for higher competitiveness of US goods and with impact on US trade balance on aggregate but also on a country-by-country basis (without risking the role of the USD as a reserve currency)

- Revenue generation through higher tariffs (as these are being paid by the tariffed nation) with the intention to fund the plan to retain low domestic tax rates (expected budget contribution of USD 5 tr over 10-year period)

- Closure of package deals on tariffs and access to the US defence shield by forcing countries from current short- /medium-term bonds to bonds with long tenors (~50-100 years) at low, near zero interest as a ‘price’ for protection

- Intent to enter (also) into unilateral currency adjustment strategies (beyond multilateral approaches)[10] to achieve quick negotiation outcomes

- Tariffs as high as 60% on China and min. of 10% for ROW

- Tariff announcements as a tool to exercise negotiation power ‘by creating fear and doubt’ and to ‘pressure nations’ with the resolution to group countries per their currency policies (quoting Treasury Secretary Scott Bessent).

- A list of trade and security criteria also instrumental for tariff negotiations

- Assumption that tariffs lead to currency offsets of the stronger currency (as experienced in 2018-19 according to early research even though not all transmission channels have been analysed yet)[11]

Arguments along the same lines have been made by Scott Bessent in October 2024 prior to being nominated as Treasury Secretary.[12]

Interestingly, some economic considerations are not dealt with in the document, i.e. the evolution of US businesses’ competitiveness and productivity over time, access to labour at a current unemployment rate of 4.2 %[13] and without stimulating inflation in case manufacturing gets relocated to the US, welfare implications for US households, domestic fiscal measures (with an influence on the trade balance and current account).

Also, behavioural aspects seem to be disregarded e.g.

- Bond market and US treasuries: China is a major investor into US treasuries (among other countries). That it will follow the US administration’s expectations to drop treasuries with shorter tenors for longer tenor treasuries with low interest seems not to be realistic. Additionally, the market has already been damaged. As investors reallocated capital from equity markets into treasuries, prices should have appreciated, and yields should have dropped. The opposite was the case. This can be interpreted as increasing risk premiums for investments which have been considered low risk in the past.

- Credibility of the US as a defence partner: The attractiveness to ‘buy’ protection from a ‘damaged defence brand’ (the US) by investing into long-term low yield treasuries has dropped as well. In the last two months, the US has repeatedly demonstrated its unreliability. From a pure economic standpoint, asking a ‘customer’ under such circumstances to purchase a service for multiple decades can be viewed as a counterparty/ credit risk issue as the counterparty might default on its commitments. As is widely known, the price for buying credit protection is an exponential relationship over time. Beyond opportunity costs for foregone interest, this would be an economic cost to be added to ‘sourcing security’ from a partner. In economic terms, this means that the risk-adjusted costs are already quite high for outsourcing protection today. This is even more the case long-term given the exponential relation. As such, in a ‘make-or-buy’ decision, the ‘make’ gains in attractiveness.

To sum up, it is hard to see that the US administration’s policy objectives on ‘package deals’ are robust and can be implemented as planned.

How to view risk & uncertainty

Different attitudes towards political risk and uncertainty can be observed …

- ‘How do we know what might happen. Even if we would know … what could we really do?’

- ‘As a risk occurs, we will deal with it.’

- ‘Well, it is pretty bad right now. But it cannot remain like that, it will get better.’

We would argue the opposite. We believe decision making should be based on realities rather than hope. Even if perspectives on risk and uncertainty remain imperfect, they provide a view how to mitigate risk and how to protect a business’s operational stability and profitability. This requires ongoing effort and lead time.

For illustration purposes, we suspect that everybody would agree that in this specific situation …

- Less US exposure or an existing US domestic manufacturing footprint (provided international supply chains are not damaged by prohibitive tariffs) would be beneficial for an export oriented European business.[14]

- Fighting of increasing hybrid attacks, protect business systems stability and intellectual property (IP) is a ‘must’ as US agencies redefine their foreign policy, cyber defence and intelligence priorities.

So, what is different in this trade conflict today?

- Flawed baseline: The hike in taxes on multiple fronts is based on counterfactual arguments and the sheer size and speed of implementation is unprecedented. Businesses are immediately affected.

- 2nd order effects also for the domestic economy are tolerated: As the conflict remains, economic 2nd order effects are initiated which are hard to understand ex-ante and hard to control. Businesses will have difficulties to evade changing economic parameters.

- Integration of policy frameworks: Trade and security policies are no longer treated separately. As trade policies are being implemented, adjustments on US national security and defence policies are already ongoing. Negotiations will have impact on businesses on both policy fronts not only with US operations but also with operations outside the US.

- Lingering uncertainty: The willingness to bluntly exercise power, threaten partners, ‘throw established litigation procedures under the bus’ and to leverage uncertainty for negotiation outcomes will lead to a trust erosion and stimulate uncertainty beyond the core conflict. This will incur additional transaction/risk cost for businesses.

Just recognising new realities in the operating environment in a business’s risk inventory will not be sufficient. It is advisable to derive specific initiatives from a set of considerations.

How to increase operational and economic resilience

There are four areas which demand attention for increasing operational and economic resilience with mounting political risk (see exhibit).

- Cost position – It is always good to have an attractive cost position. This is not the reason this is mentioned here. Tariffs (but also not tariff based trade barriers) imply changes to relative prices. As a result, a business might find itself priced out of a market. Alternatively, it would need to swallow some of the tariffs (reducing its export price) to remain competitive. This would be a drain on a business’s profitability. A loss of profitability would trigger a set of cost improvement considerations to stay competitive and profitable.

- Operating model – In order to cope with external shocks creating optionality in the manufacturing portfolio and supply chain allows to adjust quickly by ramping or swapping capacity between different sites. In theory, this sounds easy but is associated with numerous challenges as own resources and skills, suppliers and customers would need to be organized around this objective. Commercial frameworks would need to be synchronized with technical capabilities. The trade-off between low unit costs in stable operations vs. potentially elevated unit costs in flexible operations would need to be managed. Flexibility comes at a cost and additional flexibility costs would need to be justified against the potential benefit. Flexibility might already exist and might only be identified. ‘Producing’ (additional) flexibility would require a cost-benefit assessment. Operational flexibility within given capacity constraints (e.g. workforce) would contribute to inherent operational resilience.

- Portfolio – Companies operating across borders have a well-established rationale how to integrate own operations with partners and supplier. Under the influence of political risk, the conditions under which this scheme was established might no longer hold. Business conditions and/or target capital productivities might be changing. Reviewing underlying assumptions for the current portfolio set-up from time-to-time employing a political risk angle avoids being caught empty-handed with little room to manoeuvre once political risk hits. Capital productivity expectation and buffer can be maintained.

- Financial management – Exposure to financial markets within the liquid horizon[15] needs to be closely managed as political risks initiates volatility. As such this might be a strain or an opportunity to optimise a business’s financials. Thorough management of exposure to financial markets can provide downside protection to a business’s earnings. If risk appetite and capabilities allow, seeking targeted exposure might also contribute to profitability.

Summary and outlook

In the past, companies were also confronted with trade policy changes and security threats. They however operated within the respective policy frameworks negotiated between governments over time. Businesses could adjust to expected outcomes.

Today, established rules of conduct seem to have eroded already for years in some areas and seem to hit a new low of acceptance. Even though governments still act, they have less room to manoeuvre as they are confronted with a faster paced environment. This puts more burden in businesses to cope with the consequences.

Going forward, there is limited evidence today to believe that we will go back to a more stable policy environment that we have experienced in the past. Therefore, businesses need to take a proactive stand with the aim to anticipate political risks and be prepared once they materialise.

[1] Silverbergh Partners, Coming to grips with political risk, Insights 1/2017, 2017 https://silverbergh.com/files/SP-Insights_1702_Coming-to-grips-with-political-risk_0627w3r9.pdf

[2] We have already some of these compatibility issues/ diverging policy objectives today.

[3] The Budget Lab, Where We Stand: The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 Through April 2; 2025; https://budgetlab.yale.edu/research/where-we-stand-fiscal-economic-and-distributional-effects-all-us-tariffs-enacted-2025-through-april; tariffs modelled ‘in isolation’ which means not tariff responses have been taken into account

[4] VIX index expresses the 30-day implied volatility based on options prices in the S&P 500; https://www.cboe.com/tradable_products/vix/

[5] This poses additional challenges for the Fed. How it will react after a new vice-chair (this year) and a new chair (next year) have been confirmed, remains to be seen.

[6] Flach/ Scheckenhofer, US Reciprocal Tariffs and their Erosion of Global Trade Rules: Implications for Germany, EconPol Policy Brief 71, 2025; https://www.cesifo.org/de/publikationen/2025/working-paper/us-reciprocal-tariffs-and-their-erosion-global-trade-rules

[7] Corith/ Veuger, President Trump’s Tariff Formula Makes No Economic Sense. It’s Also Based on an Error., 2025; https://cosm.aei.org/president-trumps-tariff-formula-makes-no-economic-sense-its-also-based-on-an-error/

[8] World Trade Organisation (WTO), The World Tariff Profiles, 2024; https://www.wto.org/english/res_e/booksp_e/world_tariff_profiles24_e.pd

[9] Miran, A User’s Guide to Restructuring the Global Trading System, Hudson Bay Capital, 2024; https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/638199_A_Users_Guide_to_Restructuring_the_Global_Trading_System.pdf

[10] Phrasing leaves room for interpretation. Most likely targeted at China.

[11] Joeanne/ Son, To what extent are tariffs offset by exchange rates?, NBER Working Paper Series, 2021; https://www.nber.org/system /files/working_papers/w27654/w27654.pdf

[12] Entering the Fall 2024, Alarming Signs? – Fireside chat with Scott Bessent; https://www.youtube.com/watch?v=D18IRACRJio

[13] March 2025 (tradingeconomics.com)

[14] On the contrary establishing production capacity in the US to cope with the tariff regime would incur additional costs and potentially stranded investments if the tariff regime is revised afterwards.

[15] Time frame in which financial instruments have a sufficient liquidity and are therefore tradable without incurring liquidity risk and premiums.

Capital markets (1/2024)

Restoring environmental capital markets

Unlocking the potential of capital markets will be pivotal to fund the climate transformation. Although early phases of market formation have been promising, setbacks have been experienced. As such, market mechanisms have been damaged – key markets have been shrinking or face disproportional growth projections.

Recognizing initial design flaws would allow to regain trust. As a result, inflow of funds would be stimulated. Business opportunities would evolve and the prospects to cope with the climate crisis would improve.

Environmental markets can unlock capital for climate transformation

Environmental markets have been formed some years ago and have exhibited gradual growth with at times some corrections. There has been a constant debate on market design, characteristics of the traded underlying (product) and the investability/ bankability of new environmental asset classes as well as the roles of different market participants.

In the spotlight of the debate are two key markets

- Voluntary Carbon Market (VCM) in which carbon offsets are being traded[1]

- Markets for ESG investments as defined by the respective issuers[2]

- …

We do not intend to repeat arguments already made e.g. the role and relevance of rating agencies and indices, portfolio composition, investment focus – status quo vs. change, credibility of measurement and assurance mechanisms, controls, conflicts of interest, self-regulation vs. government regulation … . Neither do we try to be complete and exhaustive.

Instead, it is time to reflect and identify whether adjustments are needed.

After the heydays, the market mechanism has been damaged

For both markets, the 2019-2022 period has been very successful. Both markets have grown significantly and have gained an increasing role in investment and public policy frameworks and debates. As of 2022, investors (and customers) have increasingly questioned market integrity and promises made. In both markets there are doubts whether the climate/ sustainability performance of the respective asset classes will live up to expectations.

Additionally, the …

- VCM markets and purchases of offsets will not relief the buyer from decarbonizing his value chain to meet net zero commitments

- ESG investment markets may not necessarily provide superior performance, nor will they necessarily mitigate long-term risks.[3] In the majority of ESG portfolios, giant tech stocks have been a driver of financial performance.[4]

As a consequence, institutional investors are increasingly hesitant when considering exposure. In the VCM, investors more often turn a blind eye on Nature Based Solutions (NBS) but favor Engineered Solutions (ES). Whether these investments will in the end be successful is highly questionable given their high CO2e abatement costs.

Damaged market mechnism

As a matter of principle, the more accurately a good or an asset class can be defined, the better it can be assessed by buyers and investors. This is key for price discovery. As a result, high quality markets will gain liquidity meaning the market size will grow as purchases/ investments will be facilitated.[5]

On the contrary, if the value of an asset is not clear, the market will assign discounts to the asset. Not being able to define climate performance or risk adjusted financial performance would be reasons to assign discounts. Also, a lack of binding valuation practices and synchronization to financial calendars of companies/ investors would be a burden to determine the intrinsic value of the asset. It also raises a set of additional technical issues which need to be addressed.[6]

In the VCM, the contribution of instruments traded to climate performance has not been clear mainly due to simulation-based product design and multiyear true-up mechanisms.[7] As such this raises accounting challenges and hurdles to synchronize this asset class with financial calendars. Additionally, the lack of quality prohibits the evolution of financial markets (cash settled instruments based on the physical underlying).

In ESG investment markets, portfolio construction relies very much on ESG ratings provided by agencies. Conceptually, this is associated with some challenges. Different ESG indices are not correlated and consequently do not lead to the same outcome.[8] ESG ratings are based on scoring approaches integrating and weighting a set of parameters meant to capture environmental, social and governance aspects of the company. The capital allocation outcome of these portfolios is not entirely clear.

If for example the investor is in favour of contributing to reducing climate warming, he might want to invest into a portfolio which reflects the traceable reduction of greenhouse gases (GHG) linked to financial performance. Any other indicator would be a delusion to his investment objective. Investing into a status quo would favour low carbon businesses but might not be as effective to contribute to GHG reductions. Hence, investing into any ESG portfolio may not be the most efficient way to allocate capital.

Other investment objectives – e.g. on the ‘S’ and ‘G’ dimensions - could be dealt with by introducing exclusions or hurdles outside a weighted set of parameters.

The implications from the above observations are substantial:

- Inefficient allocation of capital, disincentive for ‘climate investors’,

- Lack of price discovery and risk management approaches,

- Limitations of instruments for GHG reductions available to companies,

- Lost opportunity for asset managers,

- …

Equity, debts and mature commodity markets have experienced an evolution leading towards liquid and credible markets today. This took years or even decades. Although this knowledge exists, it is astonishing that market participants and institutions do not ‘pivot’ sufficiently facilitating markets to recover going back to their earlier growth trajectory.

If the conditions would be different, we could sit back and observe. However, as societies we are working against a shrinking ‘GHG budget’ to keep global warming below 2 ˚C, we have no time to waste. We simply cannot afford to ‘take capital markets out of the equation’. We need more capital markets to unleash capital funding the climate transformation. Therefore, credibility in existing markets needs to be re-established paving the way for more environmental capital market activity.

Fixes and innovations

Two approaches might be followed entailing a set of activities (examples).

First, fixes need to be applied to existing markets as indicated above. If market participants want to avoid regulatory intervention, they are well advised addressing today´s deficiencies. Even though financial market regulators have been holding back, environmental markets are on their radar screen.[9]

Second, there are ample of opportunities for environmental product and market infrastructure innovations.

- In the VCM, participants would benefit from credible markets for carbon offsets and deeper financial markets linked to high quality underlyings. This market is fundamentally broken today.[10] Activities of market participants – especially the supply side - do not provide sufficient evidence for optimism. Their ability to fix the remaining issues without regulatory intervention seems to be limited. However, there is awareness that accounting practices need to be amended as a basis for regaining credibility.[11] Additionally, companies who have committed to a net zero journey cannot rely completely on offsets but must reduce GHG emissions within their (own) value chain and adjacent value chains. Although they can reduce their financing cost through environmental debt instruments already today, creating a market for bankable ‘GHG in-setting’ could be a new perimeter of asset classes accelerating the journey to net zero.

- In ESG investment markets, linking portfolios more stringently to improvements on the ESG dimensions might attract additional capital. Carbon accounting would need to be upgraded, new indices and benchmarks would be required. Biodiversity as an upcoming ESG theme is not widely reflected yet in investment approaches but a demand-pull for portfolios integrating this rationale prominently can be expected.

ESG investment markets have in the past adapted to changing requirements – sometimes with regulatory influence. If awareness is turned into action, markets should be able to provide more targeted quality environmental investment products soon.

EU CSRD regulation and taxonomy also provides a new type of infrastructure and data which could be instrumental for environmental capital market innovations.

Summary and outlook

The inception of environmental markets has been promising. However, the recent years have revealed deficiencies in market mechanisms at work in environmental capital markets. This is a limiting factor for climate performance and financial prosperity as it limits access to funding and capital market growth.

Now is time to ’pivot’ – fix existing deficiencies and introduce financial product and market innovations. A collaborative approach between market participants can speed up the process and adoption of capital market frameworks.

There is a lot to lose BUT also a lot to gain!

[1] For this debate we stick to overall market trends and do not discuss individual segments or compliance markets

[2] And as classified by the Global Sustainable Investment Alliance (GSIA); investments include environmental considerations but might have a bias towards other ESG dimensions, the ‘S’ and/or the ‘G’

[3] Le Sourd, Does ESG investing improve risk-adjusted performance?, Nice, 2023

[4] Silicon Valley buoys ESG funds, Financial Times, London, 12 July 2024

[5] Assuming that demand exists

[6] Accounting for Carbon Credits, International Swaps and Derivatives Association (ISDA), New York, 2023

[7] Probst et al, Systematic review of the actual emissions reductions of carbon offset projects across all major sectors, Zurich, 2023

[8] Berger et al, Aggregate Confusion: The Divergence of ESG Ratings, Zurich, 2022

[9] SEC, The Enhancement and Standardization of Climate-Related Disclosures for Investors, S7-10-22, Washington D.C., 6 March 2024

[10] Prices have not bottomed out yet decreasing from USD 21.28 (Jan 2022) down to USD 1.85 (Jan 2024) and USD 0.23 (Sep 2024) for CBL Nature-Based Global Emissions Offset Futures on NYMEX

[11] Kaplan et al, Accounting for carbon offsets –Establishing the foundation for carbon-trading markets, Harvard Business School, Boston, 2023

Unlocking the potential of capital markets will be pivotal to fund the climate transformation. Although early phases of market formation have been promising, setbacks have been experienced. As such, market mechanisms have been damaged – key markets have been shrinking or face disproportional growth projections.

Recognizing initial design flaws would allow to regain trust. As a result, inflow of funds would be stimulated. Business opportunities would evolve and the prospects to cope with the climate crisis would improve.

Unlocking the potential of capital markets will be pivotal to fund the climate transformation. Although early phases of market formation have been promising, setbacks have been experienced. As such, market mechanisms have been damaged – key markets have been shrinking or face disproportional growth projections.

Recognizing initial design flaws would allow to regain trust. As a result, inflow of funds would be stimulated. Business opportunities would evolve and the prospects to cope with the climate crisis would improve.

Unlocking the potential of capital markets will be pivotal to fund the climate transformation. Although early phases of market formation have been promising, setbacks have been experienced. As such, market mechanisms have been damaged – key markets have been shrinking or face disproportional growth projections.

Recognizing initial design flaws would allow to regain trust. As a result, inflow of funds would be stimulated. Business opportunities would evolve and the prospects to cope with the climate crisis would improve.Unlocking the potential of capital markets will be pivotal to fund the climate transformation. Although early phases of market formation have been promising, setbacks have been experienced. As such, market mechanisms have been damaged – key markets have been shrinking or face disproportional growth projections.

Recognizing initial design flaws would allow to regain trust. As a result, inflow of funds would be stimulated. Business opportunities would evolve and the prospects to cope with the climate crisis would improve.

Corporate Governance (1/2023)

Climate governance: Recoupling the value and sustainability perspectives

But how could a solid company performance and attractive financials be secured by recognizing the transformational nature of today´s business context and at the same time staying focused on the companies' climate agenda?

The article dicusses how these objectives could be achieved by innovating and adapting a companies' governance framework guided by a value perspective. A governance structure should support decision making and business leasders rather than erecting new hurdles for conducting business.

Commodity risk management (1/2022)

Navigating through turbulent markets

Managing commodity economics and exposures protecting company financials and decreasing vulnerability

The war in the Ukraine has caused turmoil not only in energy markets but also in broader commodity markets. As such not only companies’ financials are at stake, structural risk exposures and vulnerabilities have surfaced.

What to expect ... A new normal ...

Adjusting risk management systems

Evolving risk management agenda

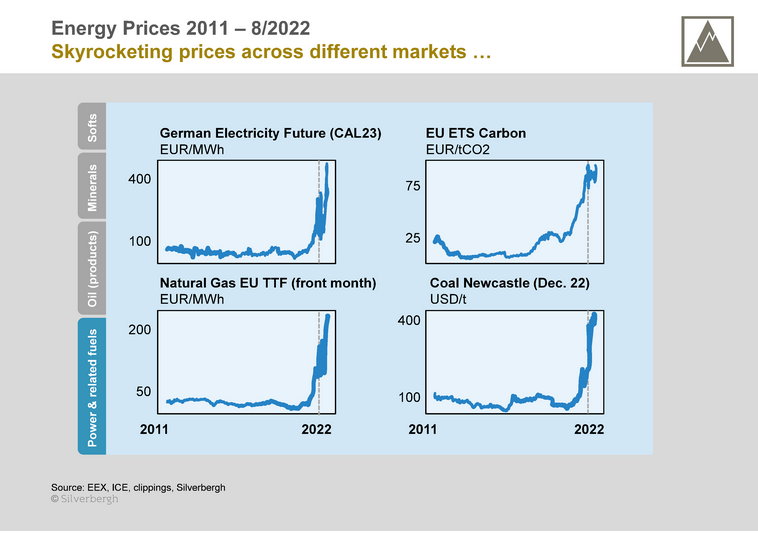

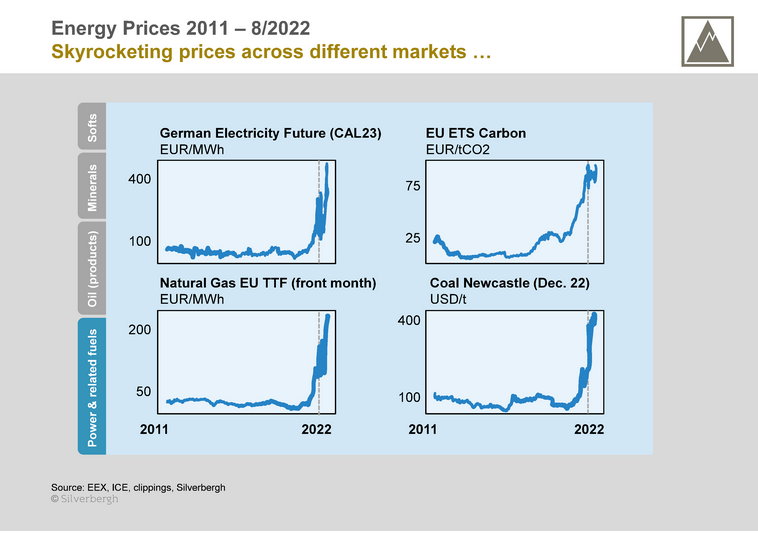

In February 2022 the war in the Ukraine started adding another element of political risk[1] to the value management agenda. As part of the conflict, Russia has limited gas shipments to Europe. Oil as well as oil product shipments get relocated to non-European destinations. This changes supply-demand economics. Therefore, energy prices have exploded.

For years energy experts have warned that as energy systems and supply are being transformed, a certain level of diversification of primary energy supplies and generation technologies should be maintained. These considerations have not been adequately recognised in energy policy frameworks.

However, a scenario in which Russian gas supplies would terminate did not really exist. Throughout the cold war, Russian gas, oil and coal shipments have been stable and reliable since the early 1970s. There has never been any indication that at some stage energy shipments might be politicised.

Favourable prices for piped gas shipments vs. LNG landed prices were also too tempting to turn a blind eye on energy diversification. A public debate about the need to diversify which started in Germany in the early 2000s ceased.

On the contrary, countries like Spain and the Baltics have been diversifying their gas supplies also driven by a different risk assessment compared to central European countries.

Signs of pre-war constraints in the European energy system – gas and electricity – have passed very much unnoticed by the broader public. As such, it is unlikely that especially energy commodity markets will soon return to a pre-crisis status quo.

Will there be a new normal and how might it look like?

It can be expected that energy prices will plateau on a higher level medium-term given decreasing global investments into energy supply in the last seven years after peaking at USD 1.9 Trillion p.a. in 2014.[2] In this environment, operational and politically induced supply shocks add to price volatility. This again will require to assign more economic capital for interacting with wholesale/trading markets.

Potential shocks in the energy system have been anticipated for years by some companies in their risk inventories and through stress tests. Even these companies are challenged managing the consequences of loopy commodity markets today.

Companies which are not as well prepared are now confronted with previously unknown risk exposures and a limited set of mitigation options. Therefore, they face additional hurdles to navigate through crisis.

After updating financial exposures and initiating potential mitigation actions, much more fundamental business model and portfolio questions might enter the agenda.

Risk transmission mechanism

What is at stake? Estimates of margin calls in European energy markets (without government intervention – prices or liquidity support) are estimated at USD 1.5 Trillion.[3]

How are companies affected?

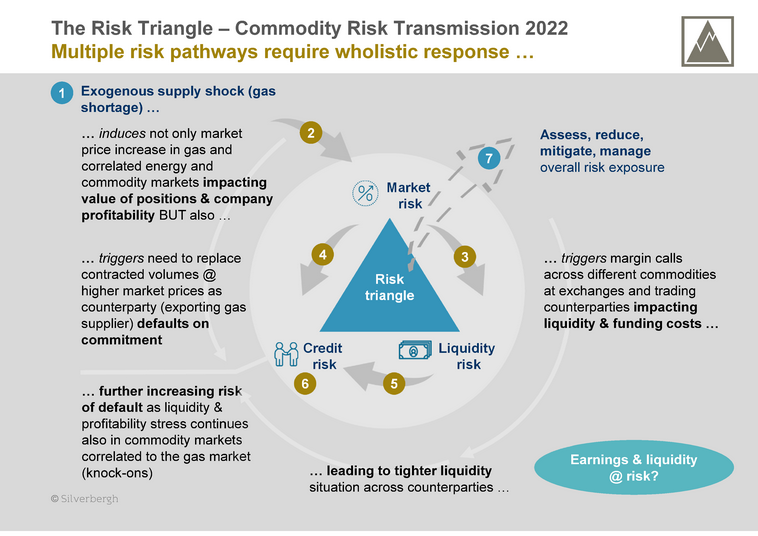

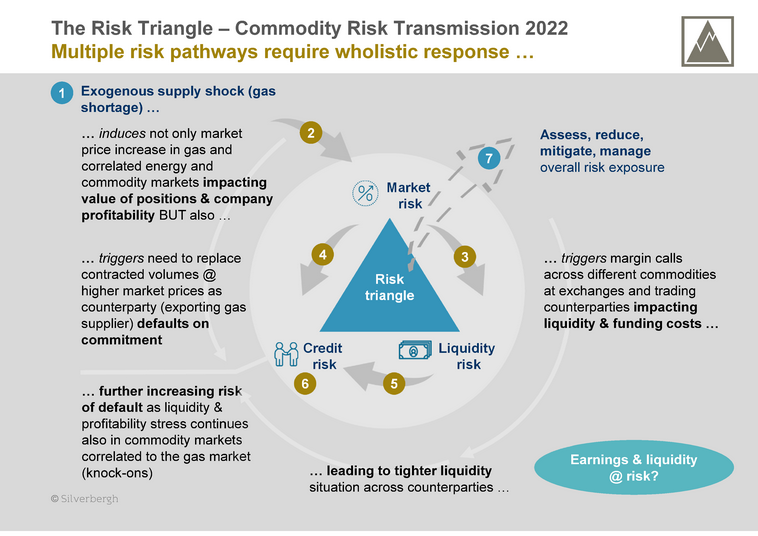

The risk triangle provides insights how risk impacts into company financials.

First of all, there is an exogenous gas supply shock, a massive contraction of gas supply with impact on all European countries.

Second, the gas supply shock manifests as market risk not only in the gas market but also in related commodity markets through spill-over effects e.g.

- Power generation – conversion economics (marginal producer in merit order)

- Oil/ oil products & coal – fuel switching

- Softs (and food production) – fossil fuel substitution (correlated with energy markets) and input factor (FMCG sector)

The value of existing positions is changing, and earnings get under pressure with rising cost positions.

Third, market risk translates into liquidity risk if margin loans of counterparties ‒ exchanges and wholesale/ trading counterparties ‒ move beyond a predefined threshold. This affects the counterparties credit process. Either more collateral is provided or the exposure with the counterparty is reduced by liquidating of positions with the counterparty.

Fourth, market risk also translates into credit (counterparty) risk if a supplier defaults on his commitment. In case of defaulting supply, replacement supplies need to be sourced from the market at higher costs.

Fifth, liquidity stress adds to financial instability.

Sixth, financial instability layers on additional credit (counterparty) risk. It might be analysed whether this is associated with concentration risk (e.g. other contractual relationships with the counterparty; increasing ‘Probability of Default (PoD)’ and ‘Exposure at Default (EaD)’.

Seventh, wholistic and potentially migrating exposures should be understood to reduce, mitigate and manage the overall risk exposure.

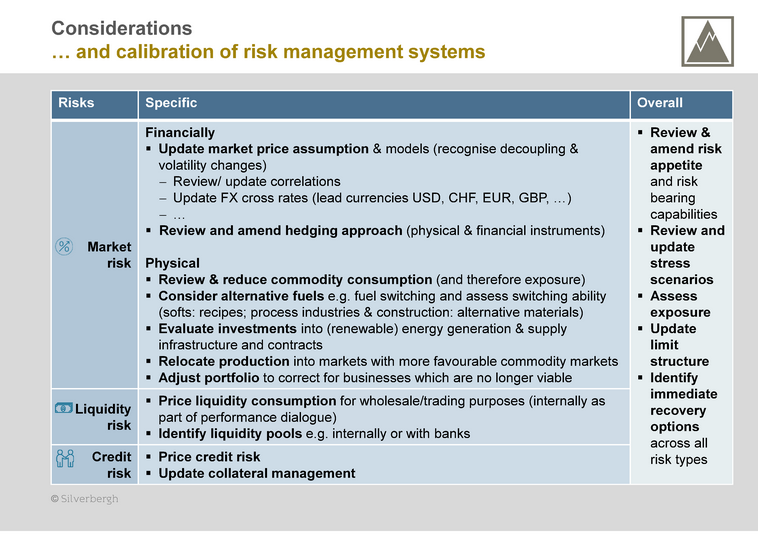

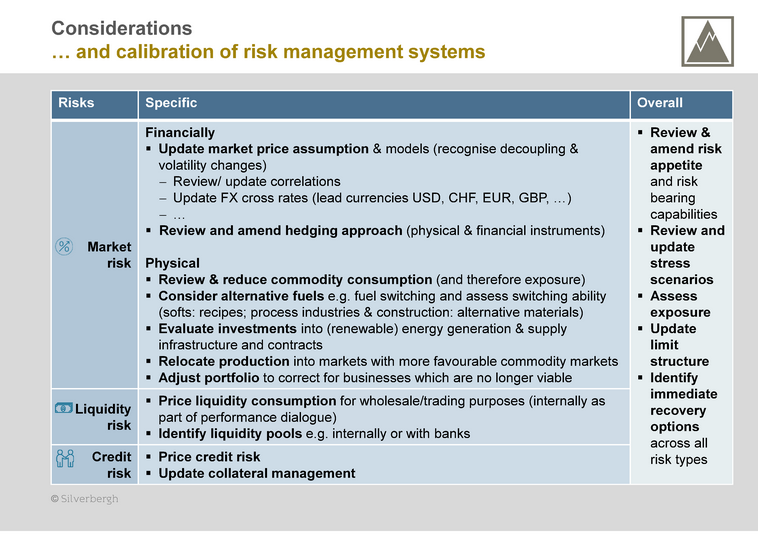

Adjusting risk management systems

For each risk type ‒ market, liquidity and credit risk ‒ a specific response is required to update risk assessments and to mitigate and manage the risks.

Across all risk types a broader response is also required. An updated risk assessment and stress testing informs immediate recovery activities with the aim to limit and mitigate risk exposure and to protect company financials.

Once the basis for a more elaborate risk dicussion on top management level has been established, it is key to update the risk appetite statement of the company defining the amount of risk and the type of exposures the company is comfortable to carry.

Recent events might demand amendments to the companie’s risk taking behavior in order to maintain the companies financial resilience and to align with shareholder expectations.

Some companies have layered on risk which they have not even been aware of and which surfaced in the last few months. In some cases even companies’ integrity has been at question and production activities have been terminated.[4]

Evolving risk management agenda

Going forward, risk assessments and risk appetite updates might also inform potential structural portfolio amendments beyond immedate tactical measures.

Especially process industries are currently reviewing their European manufacturing footprint and might consider to re-locate operations overseas.

Are all businesses still viable in today`s envinronment? What would need to change and what would one need to believe in order to continue European operations and businesses which are currently challenged.

Outlook

The war in the Ukraine causing energy prices to surge meets an economic environment which can be characterised by an increasing level of uncertainty.

Supply chain restrictions remain, geopolitical conflicts firm up globally, critical infrastructure is increasingly targeted and exposed to vulnerabilities. High energy prices contribute to economic downturn and increasing producer and consumer prices. Fiscal stability is challenged by massive government bail out programs leading to debates how to share burdens among European Union member countries.

Just updating commodity risk assessments and company positioning might fall short of the perspective which needs to be established even though some markets are correctiing already after the supply shock. The broader economic environment affecting also commodity markets should be anticipated. This enables companies to protect their financial performance and to increase their resilience as they enter into exposures and make structural changes to their business portfolio.

[1] See also Silverbergh Partners: Coming to grips with political risk; SP-Insights, 2/2017

[2] IEA: World Energy Investment 2017; IEA: World Energy Investment 2022

[3] Bloomberg: Equinor Warns of $1.5 Trillion Margin Calls: Energy Update, 6 September 2022

[4] The Economist: How to deal with Europe’s energy crisis, 8 September 2022

Climate Transformation (3/2021)

(reprint) in: Der Staat in der grossen Transformation; Jahrbuch Normative und institutionelle Grundfragen der Ökonomik, Band 19, Marburg 2021, S. 283 - 307

Regional Climate Management in line with COP21 targets

Numerous global regions and municipalities have declared «climate emergency» or consider doing so. Therefore, public administrations are tasked with implementing these new policy goals, integrating it into the administrations day-to-day management approach and resolving potential conflicts and trade-offs with other policy areas. As administrations will be held accountable for their results, they are well advised to decide on a management framework they want to follow. This article provides some suggestions administrations may want to consider as they implement their climate agenda. They can leverage experience from large corporations which continuously manage transformations successfully. A post COVID-19 social and economic environment will open new opportunities for transitioning towards a carbon light economy which should be addressed by administrations in their approach.

(COMPLETE ARTICLE: PLEASE DOWNLOAD BY CLICKING ON THE LINK TO THE RIGHT; IN GERMAN ONLY)

Climate Transformation (2/2021)

Carbon Neutrality by Silverbergh Partners

Silverbergh Partners is committed to contribute to slowing down global warming in line with the 1.5 °C degree pathway and the UN Sustainable Development goal 13. We will achieve carbon neutrality in our financial year 2020/21.

We monitor our greenhouse gas emissions (GHG) – Scope 1,2 as well as Scope 3 according to global standards as defined by the GHG protocol in Paris. Hence, we capture greenhouse gases beyond carbon expressed in kgCO2eq.

The main emissions are caused by office space and business travel. Additionally, we include emissions from operating electronic office and cloud equipment. In the pandemic we also include emissions from domestic energy consumption related to working from home under our Scope 3 perimeter.

We have amended our electricity purchasing agreement. As such 100% of the electricity consumed comes from renewable sources.

We neutralize the 2020/21 carbon footprint by investing into carbon offset projects. These projects are certified by international standards (like The Gold Standard) and rely on nature-based solutions removing carbon from the atmosphere in support of a net-zero economy.

Transportation (1/2021)

Superyachts − On the way to sustainability ...

The layout of superyachts follows to a large degree traditional concepts - hull designs and combustion engines. Key industry stakeholders and owners have joined forces to kick-off the jouney towards sustainable superyacht designs. A rating system (SEA Index) has been established measuring the carbon intensity of superyachts. This rating facilitates the dicussion in the industry around future superyacht design specifications and is increasingly receiving attention as a reference for new orders.

For further information please reference The Superyacht Eco Association (SEA): https://superyachtecoindex.com/what-is-it/

Infrastructure (2/2020)

(reprint) in: Transparency Task Force: Why we must rebuild trustworthiness and confidence in financial services; and how we can do it; London, May 2020, p- 229-233

Infrastructure investing - Increasing financial stability and prosperity

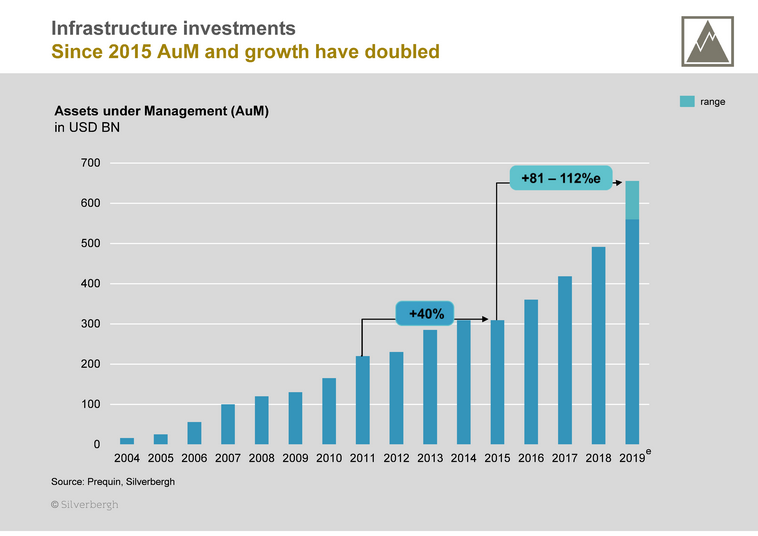

Infrastructure has evolved as an investment asset class. With increasing investment needs, the participation of private capital has increased as well. However, a funding gap remains putting economic development at risk. The 2008 financial crisis has shown that infrastructure contributes to higher resilience of the financial services sector. Hence, policy makers are well advised to further improve the conditions for privately funded infrastructure build-out. This will improve confidence in financial services offerings as it stimulates economic benefits and increases portfolio stability.

Situation today

Infrastructure investment needs have increased over time. In the late 1990 annual global investment needs were below USD ~ 2 TN.[i] Until 2040 they are expected to increase to nearly USD ~ 4 TN annually. The Infrastructure Outlook of the G20 Global Investment Hub expects total infrastructure investment needs of USD 94 TN until 2040. This implies a funding gap of USD 15 TN.[ii]

The case for privately funded infrastructure

Therefore, stimulating infrastructure investments and closing the funding gap will contribute to GDP growth. Longer-term GDP gains might even be higher if these investments are not financed by public budget deficits.[iii]

From an investor´s perspective, infrastructure is less risky than corporate bonds. It exhibits lower default rates, higher recovery rates and better ratings compared to corporate bonds. Moody´s rated 92% of infrastructure securities ‘investment grade’ compared to 42% of corporate bonds.[iv] Additionally, core infrastructure functions as a diversifier in investment portfolios vs. stocks and bonds given it`s neutral to negative correlations.[v]

This is a set-up for a win-win situation.

On the one hand, the public sector is challenged to finance its traditional obligations.

On the other hand, employees are asked to increase their provisions for retirement. This provides capital to finance infrastructure build-out.

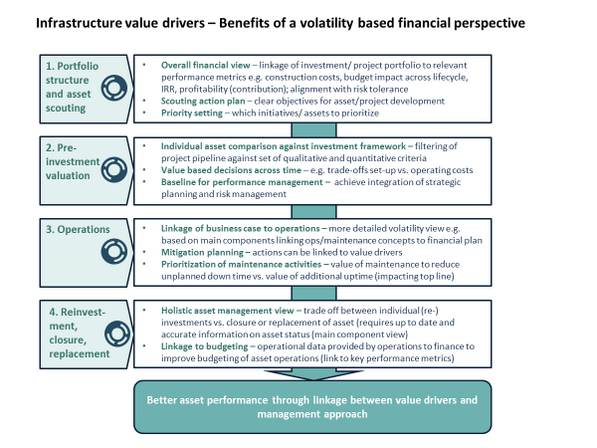

What investors require …

In order to match longer-term cash-flow profiles and liabilities, investors ̶ especially insurance companies and pension funds ̶ allocate capital to infrastructure in particular through infrastructure debt. As such they do not seek maximum returns but stable and realiable returns. They require …

- Visibility over high quality infrastructure investment project pipelines

- A stable regulatory framework mitigating political and regulatory risk. This refers to value levers directely linked to project performance like revenues, costs and contextual considerations like tax regimes and trade policies.

- Transparency over project performance across the project lifecycle and on the key volatility drivers with the ability to influence project returns.[vi]

… and what is lacking

From a European perspective, significant progress has been made to develop infrastructure markets. The European Fund for Strategic Investments (EFSI) in cooperation with the European Investment Bank (EIB) has contributed signficately not only through capital commitments to this development but also through a clear institutional framework. However, member states might further develop their national frameworks allowing for more investment activity and deal flow.

- Project pipelines: Pipelines vary in quality which translates into exposure to volatility e.g. geological conditions, construction and technology risk, uncertainty about planning processes and revenue recognition.

- Regulatory framework: At times the investment process lacks certainty and transparency. Hurdles have been a) post investment changes to initial revenue/tariff schemes (renewable energy in Souther Europe), b) opposition to facilitate private co-investments (Germany), c) unclear risk sharing mechnisms or d) dependency on 3rd party stakeholders.

- Project performance: There is a lack of clarity how to measure project performance and how to compensate investors also in the case of changing project assumptions.

Digitization as a risk management lever

Digitization of infrastructure can take a key role in helping to reconcile public and investor interests. Measuring performance has never been easier and available at lower costs than today. Sensors are increasingly integrated into fixed and mobile infrastructure (rolling stock, locomotives, ships etc.). Infrastructure performance data (e.g. usage, status, cash flows) can be attributed to the respective assets through IIoT[vii] platforms. This allows to disaggregate risk-return profiles and to reliably and timely document investment performance. [viii]

Implications for the regulatory agenda

Regulators and policy makers can enact on a set of initiatives already today.

- Provide updated high-quality project pipelines: Assess and evaluate each project from an investor’s perspective. Invest in narrowing down volatility drivers and develop a mitigation response.

- Upfront de-risk (some) infrastructure projects: Australia and New Zealand develop infrastructure projects to operational maturity. Once they are in operations and have proven to be successful, they are sold. The public sector collects revenues which are then being used to further develop the infrastructure pipeline.

- Establish a risk-sharing scheme and conflict resolution mechanism and integrate them into contractual frameworks: For illustrative purposes let’s take transportation. It is often the case that traffic forecasts are not met. This results into conflicts between governments and investors as a deterioration of this parameter impacts revenues and costs. As a consequence, investments and the associated public service might be at risk. Hence, it is advisable to seek conflict resolution mechanisms on predefined parameters which lead to adjustments in compensation if historic expectations are not met.

- Review capital requirements for new evolving infrastructure asset classes and risk-return profiles: Digitally tracking and reporting operational and financial performance allows to refine the understanding of risk profiles. This may justify differentiating capital requirements.

Summary

Maturing institutional and contractual frameworks by integrating risk-sharing schemes and conflict resolution mechnisms will create a win-win situation. Infrastructure funding gaps will be closed and the resiliance of the financial services sector will increase with direct benefits to investors i.e. pensioners and consumers.

[i] Credit Suisse (2016), Airport Anyone? Investing in Infrastructure

[ii] Global Investment Hub – A G20 Initiative, Investment Outlook (2020), refers to 2016 – 2020 time frame; https://outlook.gihub.org/

[iii] Jeffrey M. Stupak (2018), Congressional Research Service, Economic Impact of Infrastructure Investments

[iv] Moody`s (2017), Default research: Infrastructure Default and Recovery Rates, 1983 -2016

[v] JP Morgan Asset Management (2019), The correlation conundrum: Why diversification is more than “stocks vs. bonds”

[vi] Silverbergh Partners (2017), Managing Infrastructure

[vii] Industrial Internet of Things

[viii] Boris Galonske (2018), The Future of Transportation Executive Briefing 2018 (p. 156 -159), The Evolution of Smart Transportation Infrastructure

Infrastructure (1/2020)

Weathering the storm - Establishing a playbook for critical infrastructure operations

The coronavirus exposes critical infrastructure to a risk environment which is unprecedented in recent history. In order to maintain resilient operations establishing a playbook how to run critical infrastructure these days is key.

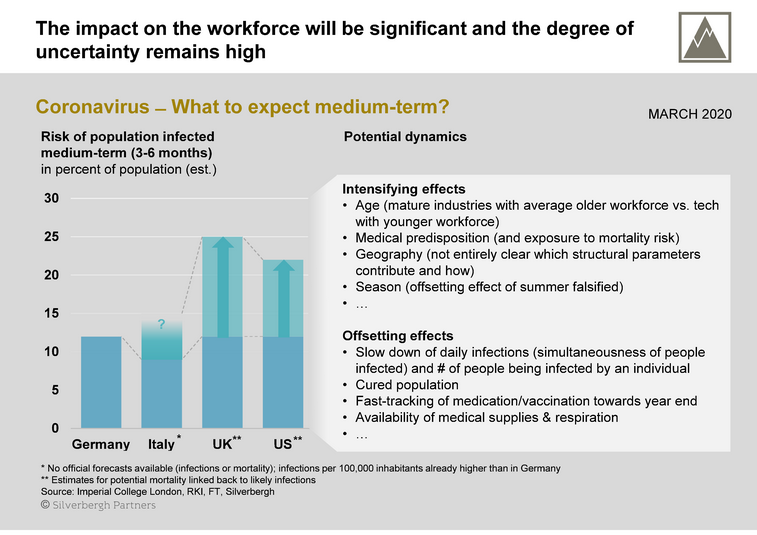

Situation today

A pandemic has been part of risk inventories of large corporations for several years. However, the accelerating speed with which the coronavirus spreads across global regions comes as a surprise. Research organisations and networks uncover new facts almost on a daily basis.

Medical researchers fast-track efforts to come up with medical interventions which in the best case will be available by year end.

Politicians and financial experts carve out policy mechanisms targeted at coping with the economic consequences of the pandemic – short-term and longer-term.

Although corporations also need to review their exposures and identify mitigation mechanisms, maintaining robust operations of critical infrastructure (e.g. IT, chemical plants, utility assets, power plants, chemical plants & sites, …) today is critical.

Hence, as vulnerability of operations increases, stabilising the management response and reducing complexity is key in order to maintain operational resilience.

What stakeholders expect

Clearly, exposing critical infrastructure to unnecessary vulnerabilities not only puts companies businesses at risk but may compromise expectations of the broader stakeholder environment. Stakeholder expectations are the following:

- Customers: Access to services (whether these are utility services, infrastructure services to large industrials or payment operations in case of banks etc.).

- Shareholders: Profitability of business and stable cash flows.

- Employees: Stability of employment and compatibility of private and professional demands.

- Regulators & public: Stability of operations & uninterupted service; compliance with general rules how to conduct business.

Under disruptive conditions as we experience them today, some of these expectations are conflicting. Resolving these conflicts requires an assessment of trade-offs, resolution options and active communications with all stakeholder groups. Communication will not only have to address needs and requests tactically. It has also to be set up to rationalise and document management decisions and behavior after the crisis.

How risks materialise

Understanding how risks materialise will help to guide developing adequate responses. Some risk exposures triggered by the pandemic are worth reviewing (examples).

On company level: A company provides the business and operational framework for critical infrastructure operations and the associated businesses. As such key risks are …

- Inherent business profitability risk and financial consequences driven by the evolution of revenues vs. costs.

- Credit/ counterparty risk (delayed cash-inflows and exposure to defaults of counterparties or replacement risk).

- Reputational risk and related financial consequences.

- Operational risk with regard to core admininstrative processes and responsibility for the overall operating framework.

- Liquidity risk and implications for refinancing opportunities and refinancing costs.

- …

On operations and asset level: On this level, management needs to maintain the ability to operate critical infrastructure and assets in order to serve customer needs.

- Staff availability risk (own personnel).

- Procurement stability risk (services incl. agency staff and utility services, consumables, investment goods and parts) driven by operational risk of non-availability and counterparty/ credit risk in case of default.

- Shipment volatility risk driven by ramp downs or cycling of customer demand influencing sales and implying operational risk associated with maintaining the minimum viable level of critical asset operations and financial risk as revenues and costs are impacted.

- Cyber risk may impact stable asset operations as more staff requires remote access to company networks. The likelihood of cyber attacks increases.

- Risk of social unrest and impact on integrity of sites and interference with core operations. Also likelihood of sabotage increases as social instability rises.

- …

Mitigation activities might reach across several of the above risks. They would need to be detailed out specifically addressing every risk driver but could be aggregated up afterwards. Examples of mitigation actions are

- Amended work/ shift models (including multi-skilling of staff). This however requires training upfront.

- Insourcing of activities and hence less dependence on contractors or staff remotely located.

- Customer assurance and agreement with customers on service levels and adjustment of demand. This allows concentration of own activities in certain sites/ locations. Potentially, value-added services and products could be offered helping customers to handle todays situation.

- Workforce motivation and relations by offering relieve from daily burdens and by providing transparent and timely communication.

- Build up of redundancies (e.g. procurement contracts with optionality or sourcing of critical asset components; diversification and tiering of suppliers; risk assessment of critical supplies and parts with options to establish own stocks, …).

- Financial hedging pegged to procurement & sales of commodities or exposure to exchange and interest rates (on company level).

- …

Playbook for critical infrastructure operations

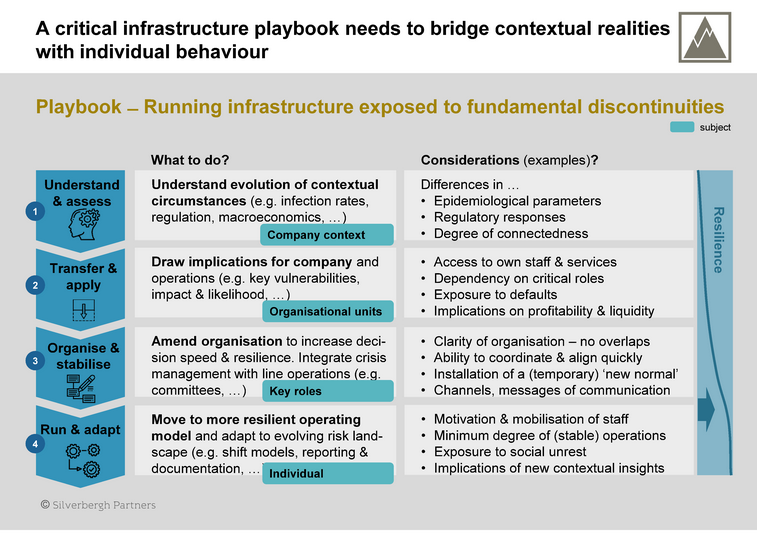

The objective of a playbook for critical infrastructure operations is to create stability in the management response to an environment which is exposed to fundamental discontinuities.

- Faster response to operational needs and a rapidly evolving risk environment.

- Reduction of operational instability by introduction of amended (temporary) operating framework stress-tested against risk-drivers, introduced and practiced prior to materialisation of risks.

- Clarity of responsibilities and accountabilities (line organisation vs. committees/ organisation by exception).

- Reduction of complexity through a clear protocol how to handle the situation across organisational boundaries.

- Improved management oversight through clear milestones by initiative/ workstream and reporting format (including KPI).

- Mitigation and containment of financial consequences by integrating risks on operational and asset level into corporate financial risk perspective.

- Documentation of management decisions for post crisis communication.

How should a playbook for critical infrastructure operations be established?

- Understand & assess: The evolution of how the pandemic spreads should be continuously monitored. If critical infrastructure is integrated into global supply chains, exposure to these supply chains should also be understood. This can be a risk as well as an opportunity as production could be shifted. The same holds also true for suppliers and customers. Regulatory responses should be understood as they not only have implications for operations but also for dealing with the financial consequences of the pandemic (e.g. short-time compensation, fiscal programs, …).

- Transfer & apply: The contextual risk environment needs to be linked back to company operations. It should facilitate highlighting vulnerabilities of organisational units or critical infrastructure. Areas of intervention and mitigation should be prioritised considering likelihood and impact if certain events occur. This perspective also provides the structure to identify mitigation activities which then also informs how to amend the organisation (e.g. shift models).

- Organise & stabilise In an amended organisational setting not only organisational structure gets addressed. Also, roles and responsibilities will need to be updated to incorporate mitigation activities. In this effort, the decision needs to be taken whether tasks should be integrated into a line organisation or whether they should be dealt with in a committee setting. Two key drivers will influence the decision, a) the degree of exception of the respective task and b) the number and complexity of interfaces.

- Run & adapt Once the amended organisation is established, it needs to develop a work routine. This requires discipline throughout the organisation resulting in a more stable and resilient operational set-up that will drive individual behaviour throughout the organisation. If this is achieved, the journey is not completed but a key part of the mission is achieved. As more risks unfold or realities change, operational adjustments can be made along the lines established already in steps 1 & 2.

In the transition: Staying in control

How can the transition be managed and how can it be ensured that management is not overwhelmed by complexity?

We strongly recommend establishing a program management office (PMO). This can either be integrated into a committee setting or a line function. The obligations of the PMO are …

- Manage transition process to keep track of activities by workstream/ initiative, identify interfaces between activities and facilitate alignment. Prepare and update integrated management reporting.

- Document management decisions and rationales for addressing trade-offs.

- Mobilisation of corporate resources in alignment with management as new situations evolve.

- 1st point of contact beyond established reporting lines as new situations evolved, rapid responses are required and obligations are not defined. This only holds true if no other rapid response mechanisms are in place and could be easily activated.

- Stakeholder communication might be conducted or supported by the PMO depending on whether a corporate communication functions exists. As such, the PMO can play a more or less active role in stakeholder communication. As communication needs to be routed in a coronavirus fact base, this expertise is most up to date and accurate at the PMO.

The PMO should report into top management to ensure instant decision making and organisational alignment.

How to proceed?

As long as there are still degrees of freedom to choose a management approach, a timely decision should be taken how the company and critical infrastructure operations should be managed through the crisis.

Under normal circumstances any of the above steps would be conducted thoroughly and backed up by well-founded analysis. In todays environment, the above outlined process would need to be fast-tracked and conducted in a very pragmatic and truncated manner.

Outlook

It is to be expected that once the infections decrease, the decision needs to be taken whether to release restrictions and to convert back to a ‘normal’ operating mode as practiced prior to the pandemic. It should be anticipated that operations might be confronted with a backlash of increasing infections. Hence, it might be advisable to continue in the amended ‘new’ operating mode until these backlashes can be ruled out. This however should be subject to a risk-benefit assessment once the situation occurs.

Commodity trading (4/2019)

Monetizing digitization levers

Commodity trading suffers from shrinking margins and in some commodity classes also from low price volatility. At the same time operating environments struggle with manual routines, legacy processes and systems resulting in high cost income ratios (CIR).

How can this challenge be addressed and how can the profitability and the resilience of trading businesses be increased?

Commodity trading exhibits still several manual routines in its workflows, given the physical nature of the business and established processes in the industry. At the same time margin pressure increases as the inherent profitability of several trading businesses decreases. How can this be addressed?

Commodity trading business characteristics

Commodity trading businesses are typically lean by nature. Several years back, high performing businesses exhibited cost-income ratios (CIR) in the range of high 30% - medium 40%. These days these ratios are significately higher. Large European commercial banks – as a comparison – even exhibit cost income rations in the range of 70 % - 90% +.

In order to tackle the profitability gap, analytics and middle office activities have been scaled down.

However parts of the trading process have remained untouched.

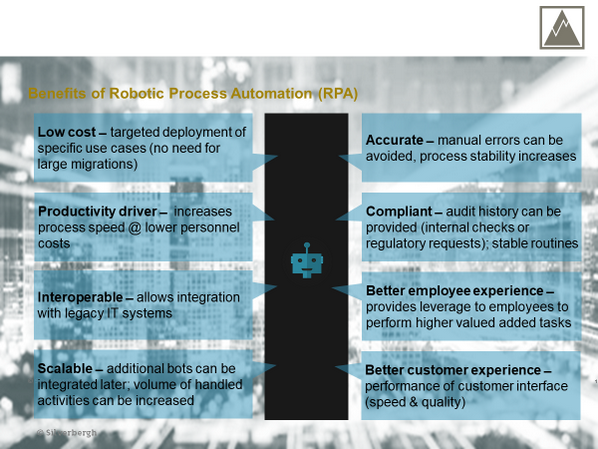

How digitization can help

Targeted digitization initiatives can help to

- Imrove process quality and avoid errors

- Increase productivity within the end-to-end trading process

- Accelerate trade execution & administration

Identifying digitization opportunities will therefore help to improve the CIR while at the same time promising a high digital ROI.

What to look for

Manual routines are still quite widespread across the trading process. Examples are

- M2M valuation of commodity stocks based on up to date inventories

- Creation of daily P&Ls and reconciliation of positions (volume & price grid)

- Trade confirmations & post-trade administration

- Reconciliation of payment data with contract data

- …

Additionally, reason for manual routines are e.g.

- Several legacy systems (e.g. CTRM, supply chain & storage, processing/ production, contract management)

- Unstructured data through communication by email, fax, phone etc.

If these characteristics are being observed, then digitizing some of these activities should be considered.

Reservations about digitization

At times there are reservations about digitizing initiatives and a bias to continue with legacy processes and routines.

- Costly larger scale migrations of ERP and CTRM (as experienced in the past)

- Additional burden on key personnel and as a result slippage of key commercial activities

- Operational risk (stalling operations)

- Loss of control (over automated routines and across the application lifecycle)

Each of the above reservations can be addressed by a well configured digitization approach.

- Legacy systems like ERP and CTRM can remain in place. Distinct and well-defined process routines can be automated by providing the link into existing systems

- The need to draw on internal personnel can be limited by avoiding larger scale migrations

- Individual process automations can be tested and even confirmed manually (if required). One can opt for the degree of automation vs. cooperation with automation routines being introduced.

- Complete visibility & transparency can be created by installing an integrated automation platform enabling

- full visibility of all automation routines established (Robotic Process Automation -RPA),

- processing status for each of the robots,

- linkage to data sources (as required) for manual reconciliation,

- digitization of unstructured data into manageable data formats (e.g. from fax to CSV),

- transparency on automation requests, use cases and automation requests throughout the organisation.

How to approach trading digitization

A couple of aspects should be kept in mind when considering automation:

- Identify & quantify automation opportunities

- Evaluate impact on company

- Improve to be automated process prior to automation

- Integrate execution of tasks conducted by humans and robots

- Track end-to-end process performance & integrate early warning signals in case of misperformance

- Continous administration of process architecture

- Continous improvement (and amendment of process architecture as required)

Additionally, technology selection should aim for a well respected and dynamic option. There are technology choices which are accepted in business environments with high security precautions and which have also been licensed by the US government.

Within a few weeks, automations use cases can be identified and implemented. Low hanging fruits should be pursued early on whereas automation opportunities with higher complexity might be pushed forward on the implementation agenda (e.g. image recognition).

If these considerations are kept in mind, financial performance will improve and the resilience of the business will increase.

Outlook

Automation opportunities in commodity trading are still not sufficiently leveraged. They are a key competitive factor going forward. From a cultural perspective, automation techniques match commodity trading organisations characteristics by providing lean and pragmatic access to productivity levers. There is no need to commit to large scale IT spending and hope for monetization in later years.

Infrastructure (3/2019) - REPRINT: The Future of Transportation - EXECUTIVE BRIEFING 2019

Funding games - digital technology in mobility

New mobility concepts are spreading. Some are driven by venture-funded start-ups; others are pursued by incumbents investigating new routes to market. So far, digital technology has played a pivotal role in helping to raise venture capital for typically asset-light platform businesses with the ability to scale quickly. Going forward, more asset investments are required to take mobility business models mainstream. This requires funding, and even though asset-light business models will continue to exist, asset owners need to be rewarded. Can digital technology support securing funding or is it a hurdle for future funding?

(COMPLETE ARTICLE: PLEASE DOWNLOAD BY CLICKING ON THE LINK TO THE RIGHT)

Klima-Transformation (2/2019)

Klimanotstand ... Was nun?

(Climate emergency ... How to manage?)

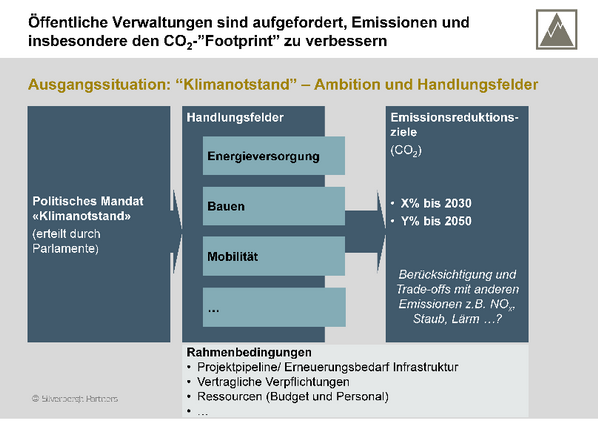

Verschiedene öffentliche Körperschaften - Regionen und Kommunen – rufen den Klimanotstand aus. Verwaltungen sind daher beauftragt, diesem neuen Politikfeld Rechnung zu tragen, es mit anderen Politikfeldern in Einklang zu bringen und es zum Bestandteil des täglichen Handelns zu machen. Ebenfalls wird der Nachweis zu erbringen sein, dass Emissionen reduziert worden sind. Ein dezidierter Management-Ansatz ist deshalb unerlässlich.

«Think global, act local …»

Der Klimawandel hat nun das Handeln auf der regionalen und kommunalen Ebene erreicht. Einzelne Klima-Massnahmen sind nicht mehr ausreichend. Vielmehr fordert die politische Willensbildung, dass ein strukturierter Ansatz verfolgt wird, indem regionale bzw. kommunale Aktivitäten auf ihre Klimaauswirkungen zu untersuchen sind.

Während der politische Auftrag klar ist, ist die Implementierung komplexer.

- Ganzheitliche Betrachtung ̶ Die derzeitige Debatte konzentriert sich auf CO2-Emissionen. Es ist jedoch zu beachten, dass es auch andere Emissionstypen gibt, die nicht zu vernachlässigen sind. Dies hat die Debatte um Feinstaub-, NOx und Lärmemissionen verdeutlicht.

- Wahl der Handlungsfelder ̶ Vor dem Hintergrund von Effektivitäts- und Effizienzabwägungen sind die Handlungsfelder auszuwählen, die zum einen beeinflussbar sind, und die es erlauben, Emissionen zeitnah beeinflussen zu können.

- Ex-ante vs. ex-post-Steuerung ̶ Einige Entscheide zum Klimanotstand sind derart formuliert, dass Massnahmen auf ihre Klimaauswirkungen hin zu untersuchen seien. Es handelt sich somit um eine ex-post Betrachtung. Die Frage ist, wie ex-ante Klimaanforderungen in den Steuerungsansatz integriert werden können, um somit die Ergebnisqualität zu verbessern.

- Ressourcenallokation ̶ Der politische Auftrag ist in der Regel sowohl innerhalb eines definierten Personaltableau als auch innerhalb bestehender Haushaltsrichtlinien zu bewerkstelligen.

- Erfolgsnachweis ̶ Die Verwaltung ist politische Instanzen gegenüber nachweispflichtig. Insofern ist zu empfehlen, im Zuge der Entwicklung von Klimareduktionsmassnahmen auch ein Klima-Controlling zu etablieren. Hier ist zu entscheiden, wie gegenüber einem Bezugspunkt mit Veränderungen umzugehen ist z.B. Veränderung des Leistungsspektrum der Kommune (Infrastruktur, Ausbau ÖPNV, …) oder etwas Bevölkerungswachstum (-rückgang).

Für diese Themenkomplexe sind Antworten und Herangehensweisen zu entwickeln.

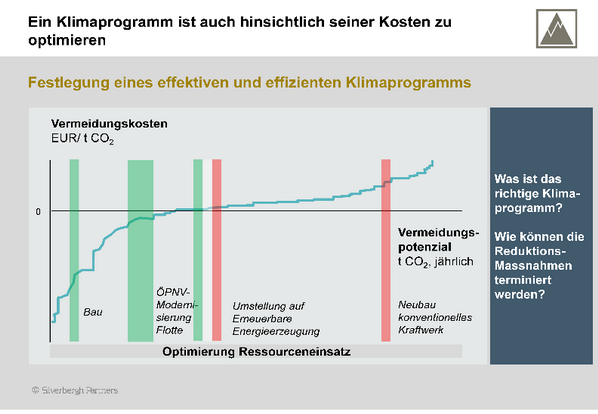

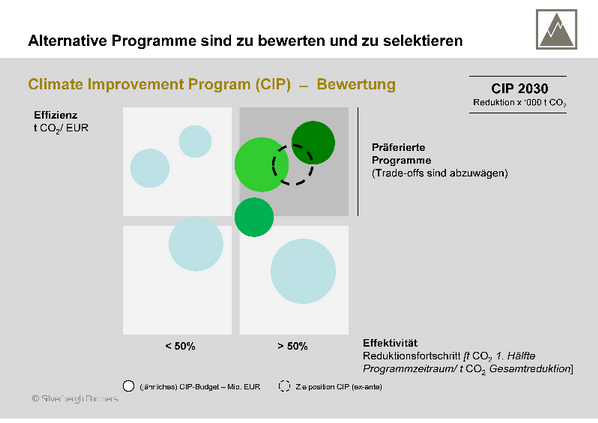

«Bang for the buck»

Jede Klimamassnahme hat Budget-Implikationen. Gäbe es keinen Haushaltsdeckel, könnten alle Massnahmen verfolgt werden.

Da dies jedoch nicht der Fall ist, ist es nicht nur aus haushalts- sondern auch aus klimapolitischen Erwägungen her geboten, die gegebenen Mittel möglichst effizient einzusetzen. Zieht man die CO2-Vermeidungskosten als Referenz hinzu, ist bei gegebenem Budget beispielsweise mit baulichen Sanierungs-Massnahmen eine grössere CO2-Reduktions zu erreichen als mit dem Neubau eines konventionellen Kraftwerkes.

CO2-Reduktionsmassnahmen sollten daher nicht ad hoc sondern über einen längeren Zeitraum geplant werden. Massnahmenbündel sollten dann bezüglich ihrer CO2-Vermeidungsleistung sowie ihrer Budgetimplikationen bewertet werden. Grundlage für die Massnahmenentwicklung müsste aber zunächst eine «long list» von möglichen Massnahmen sein.

Für diese wären folgende Elemente zu klären.

- Meilensteine: z.B. Start- und Endpunkt der Realisierung

- CO2-Vermeidungseinfluss: Wann ist mit dem CO2-Vermeidungseinfluss zu rechnen? Für wie viele Jahre kann dieser angenommen werden?

- Budgeteinfluss: Was ist an Haushaltsmitteln für die Realisierung der Massnahme zu veranschlagen? Welche Personal-Ressourcen würden gebunden?

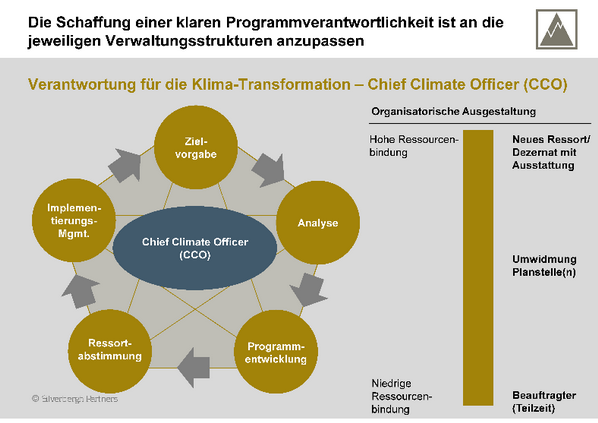

Wie steuern? Der Chief Climate Officer …

Es ist evident, dass die aus dem politischen Auftrag erwachsenden Ausgaben nicht «mal eben so» von der Verwaltung übernommen werden können. Die Festlegung einer expliziten Verantwortlichkeit und Rolle ist erforderlich, um alle Klimabelange zu bündeln und über Schnittstellen hinweg Erfolg gewährleisten zu können.

Die Verantwortlichkeit des Chief Climate Officers (CCO) umfasst die Übersetzung des politischen Auftrags in Zielvorgaben, die Analyse des Emissions-Footprint und des Einflusses von Einzelmassnahmen sowie deren Zusammenfassung in einem Klimaprogramm.

Dieses ist zwischen den verschiedenen Ressorts (Bau, Verkehr, Immobilienverwaltung, Energie etc.) abzustimmen insbesondere aber auch mit dem Finanzbereich.

Ebenso ist ein Implementierungsmanagement aufzusetzen. Darunter sind verschieden Aspekte zu bündeln:

- Implementierungsverantwortlichkeiten, Zeitplan und Meilensteine

- Implementierungs-Controlling – sachliche Realisierung

- Impact-Controlling – Nachhalten der Emissionsreduktionen und Einpflegen in die Klimabilanz

- Finanz-Controlling – Nachhalten von Budgeteffekten

Wie der CCO in die Organisation eingebunden ist und wie dieser auszustatten ist, ist von den jeweiligen Gegebenheiten abhängig. Einflussfaktoren sind etwa Grösse der Region, Umfang des Auftrags bzw. des zu erwartenden Klimaprograms. Der CCO kann an eine bestehende Organisationseinheit (z.B. Umwelt oder Finanzen) angekoppelt werden bzw. neu als Organisationseinheit geschaffen werden. Mögliche Ausgestaltungsformen sind zu bewerten.

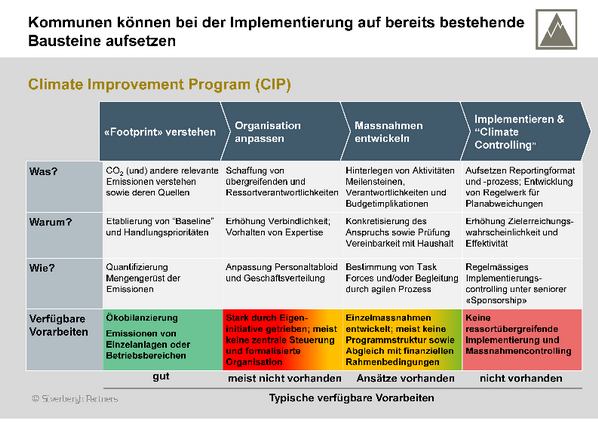

Implementierung eines nachhaltigen Klimaprogramms

Zur Entwicklung eines «Climate Improvement Programs (CIP)» kann in der Regel auf bereits bestehende Arbeiten zurückgegriffen werden. Dazu gehören u.a. die Erhebung des CO2-Footprints bzw. bereits erarbeitet Ökobilanzierungen sowie individuelle Klimamassnahmen (z.B. Modernisierung Busflotte durch Hybride, Bau von dezentralen Energieversorgungeinrichtungen wie BHKW und Solarkraftwerken, Wärmesanierung Schulen/ Verwaltungsgebäude). Insbesondere bei den teilnehmenden Kommunen am «Masterplan 100% Klimaschutz» sind umfängliche Arbeiten bereits erfolgt.

Die Bearbeitung von einzelnen Klimamassnahmen erfolgt in den verschiedenen Ressorts, sollte aber beim CCO als Gesamtverantwortlichen bzw. Projektverantwortlichen zusammenlaufen. Vor der Detaillierung von Einzelmassnahmen empfiehlt es sich, eine Gesamtreduktionserwartung zu etablieren und auf die einzelnen Ressorts herunterzubrechen. Auch wenn das CIP vom CCO verantwortlich geführt wird, ist aufgrund vieler Schnittstellenthemen zu überlegen, einen Lenkungskreis aus den Bereichsverantwortlichen einzurichten, die die entwickelten Massnahmen verabschieden. Andernfalls ist mit einem grossen Implementierungsrisiko zu rechnen, weil die notwendige Verbindlichkeit fehlt.

Ambitionen und Ergebnisse sind zu messen, bzw. wie oben beschrieben einem Controlling zu unterwerfen. Dies ist wiederum die Voraussetzung, offen und proaktiv kommunizieren zu können und die regionale Klimaagenda zu prägen und weiterzuentwickeln.

Bei der Festlegung des CIP sind die Charakteristiken alternativer CIP-Ausgestaltungen gegeneinander abzuwägen. Effizienz und Effektivitätserwägungen sind mit Budgetzielen in Einklang zu bringen. Ist diese Abwägung erfolgt, kommt das der Nachhaltigkeit des Programms zugute. Der Reduktionspfad ist spezifiziert. Die dafür erforderlichen Haushaltsmittel sind eingeplant. Soll-Ist-Abweichungen können im Controlling-Prozess identifiziert und adressiert werden.

Ausblick

Das «Climate Improvement Program» ist eine hervorragende Möglichkeit, den Bürgerdialog zu prägen. Verwandte Leistungsangebote können besser kommuniziert werden. Auch kann das Verständnis über das Präferenzprofil des Bürgers geschärft werden, was wiederum in das CIP einfliessen kann. Gegebenenfalls können auch plebiszite Elemente zu wichtigen Richtungsentscheidungen eingeflochten werden.

In Summe kann das gemeinschaftliche regionale/lokale Bewusstsein gestärkt werden und ein Verständnis für Verwaltungshandeln gefördert werden, indem Klima-Massnahmen ein selbstverständlicher Teil politischen Handelns werden.

Commodity trading (1/2019)

Commodity trading value drivers 2019

Introduction

As we start into 2019, the hope is that the upcoming year will offer more trading opportunity than in the previous year. 2018 has been disappointing in terms of overall price development but did offer more trading opportunity by the end of the year. Can this positive sentiment be taken into 2019 and will it prevail throughout the year? What are the key value drivers to watch as the year matures?

Starting point

Looking back, some of the value drivers with a negative impact on trading activity and opoortunity we pointed out already in 2017 prevailed into the 2018 trading season incl. e.g. low volatility, narrow correlations, limited liquidity at the long tail. Overall after a good start in the beginning of the year, commodity prices contracted over the 2018 trading period. By the end of the year, volatility picked up attracting more capital. As such, some market participants contempleted to ramp up their trading activity. So, what can we expect from the 2019 trading season?

Trends to watch

In line with our overall value driver perception, we expect that political risks will play a more important role than in the past. Discontinuities in the political arena become more frequent and will leave their mark on trading markets. Will this be negative per se for trading activity? No, on the one hand, economic supply-demand fundamentals might be affected. On the other hand, this will also be a driver for volatility which creates trading opportunity. If this is captured and if market participants ‘play their hand successfully’, it will offer the opportunity to capitalize the existing trading activity and hence renew the ‘license to trade’. This is a challenge several commodity trading market participants intend to resolve in 2019.

Independent of supply-demand fundamentals in different asset classes, overarching patterns are important to understand as they may leave their mark on a single market. As several markets are globally traded and USD denominated, the role of the US and the state of the demand side are of utmost importance.